4 Ways a Nuanced Account Risk Assessment Strategy Can Help Banks Reduce Fraud and Spur Business Growth

Application fraud prevention isn't what it used to be. Digital account opening processes are now the norm. Fraudsters are exploiting weaknesses in traditional risk assessment systems. And financial institutions (FIs) are struggling to prevent criminals from becoming customers.

In the first half of 2024, fraud was suspected in 6.5 percent of all attempted digital account openings—making it the riskiest stage of the customer journey.1

For banks and credit unions, the stakes are high and the challenges are mounting.

FIs are witnessing a rise in both the volume of fraud activity and the variety of fraud tactics they need to manage.2 We expect this trend to continue in the coming years or even pick up pace—particularly as fraudsters find new ways to use rapidly emerging generative AI tools to their advantage.

Recent identity fraud trends are complicating new account risk assessments.

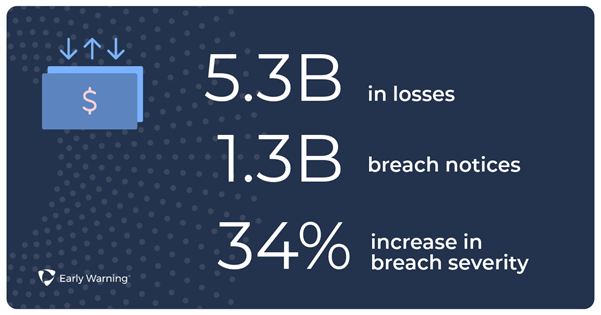

According to a 2024 Javelin report, new account fraud resulted in $5.3 billion in losses in 2023.3

And in 2024, data compromises reached near-record levels, resulting in more than 1.2 billion breach notices being issued to victims.4

What’s more, criminals have been adjusting their tactics to ensure the identity data they steal is as useful as possible—with a focus on quality over quantity. And the shift is paying off. From 2023 to 2024, U.S. data breach severity (the ability of a breach to enable identity fraud) rose 34 percent.5

With access to enormous amounts of high-quality identity data, it’s become easier than ever for fraudsters to create sophisticated synthetic and manipulated identities, which they can use to pull off a range of nefarious activities—including application fraud.

Traditional account risk assessment strategies can hinder a bank’s growth.

To combat application fraud, FIs must be able to verify that an applicant is who they say they are and confidently assess fraud risk—at the point of account opening.

As FIs bolster their loss prevention strategies to address evolving fraud tactics, however, they must be careful not to inadvertently add unnecessary friction to the risk assessment process.

Consumers expect digital account openings to be fast and easy. If the onboarding process takes more than five minutes to complete, they’ll often abandon the application and move on to a competing institution.6

But friction for consumers isn’t the only impediment to business growth during a bank’s account risk assessment process.

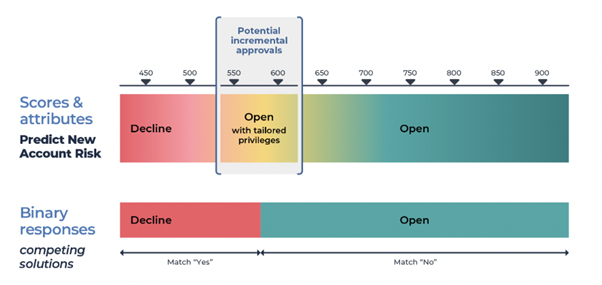

FIs must also be careful not to exclude potentially valuable applicants due to rigid “yes” or “no” decisioning rules. To grow market share—and support financial inclusion—banks must be able to make more nuanced approval decisions by assessing an applicant’s risk in greater context.

To achieve this level of insight and control over account openings, FIs need access to broad and deep data, from across an individual’s banking history.

A nuanced account risk assessment strategy gives banks a competitive edge.

Banks and credit unions that adopt a nuanced approach to risk assessment can make more informed account approval decisions—and confidently grow their markets. They can:

- Open more accounts: Insight into a consumer’s deposit account history gives FIs the perspective they need to approve more applications—tailoring account privileges to align with the institution’s risk threshold.

- Protect against new account losses: Deep data intelligence (e.g., predictive scores; insights into applicant’s account history and behavior) helps FIs better understand the risk of default due to first-party fraud or account mismanagement.

- Balance risk, efficiency, and compliance: A more flexible approach allows FIs to use risk insight data in a manner that aligns with their objectives for risk mitigation, operational efficiency and regulatory compliance.

- Improve financial inclusion: Behavioral insights add context to risk scores, allowing FIs to open their doors to a wider population of historically underserved consumers.

Early Warning’s Predict New Account Risk solution, for example, draws on broad deposit performance data to provide FIs with the intelligence they need to answer questions like:

- How likely is the applicant to commit first-party fraud?

- How likely are they to default on the account due to mismanagement?

- Can I do business with this person?

- What account services and privileges can I offer the applicant?

Bank-contributed data is a powerful tool in the fight against fraud.

Early Warning is the Trusted Custodian® of the National Shared DatabaseSM—which contains participant and scored account data on 727 million7 deposit accounts—as well as billions of transactional records contributed by thousands of financial institutions.

With access to accurate and continuous account performance data, FIs can adopt a nuanced risk assessment strategy that promotes bank growth while reducing fraud losses.

Learn more about how Early Warning can help you confidently expand your customer base.