Bring Trust to the Financial Moments That Matter

Trusted From the Beginning

For three decades, Early Warning® has given financial institutions (FIs) the confidence to lead boldly. We started in 1990 with a shared data model to verify payments and deposits, added identity verification tools in the 2000s, and then launched Zelle® in the 2010s. We now combine our payment risk and identity verification tools into a holistic Early Warning Platform. We’ve enabled millions of new account openings and helped FIs save hundreds of millions of dollars by preventing losses.

Fraud Prevention in 2022*

49 million New Account Inquiries Screened

2.7 Billion

checks screened

$13 billion

high-risk transaction alerts

$1.4 Billion

in potential check fraud avoided

Early Warning® as the trusted custodian for the National Shared DatabaseSM Resource

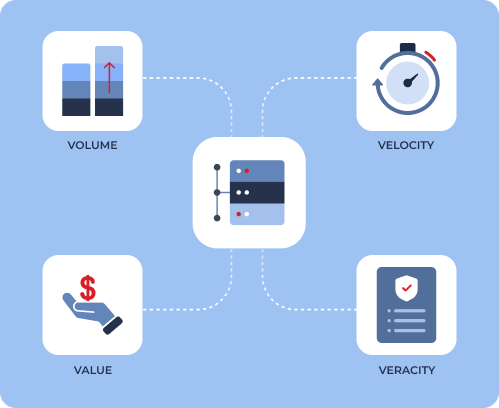

Our model uses account data from thousands of FIs to provide trusted insight. This invaluable resource incorporates information from billions of transactions to produce predictive risk scoring and help you make informed decisions.

The Early Warning® Advantage

Leverage 30 years of experience to enhance your new accounting opening strategy.

- Innovative

Early Warning® has been at the forefront of technological development for 30 years, despite the rapidly changing global financial landscape. - Collaborative

Early Warning® works with and gathers data from thousands of FI’s around the world, giving us unique insight into the needs of our partners. - Trustworthy

45 of the world’s top 50 financial institutions work with Early Warning®.

Learn More About Early Warning®

Interested in learning more about our Payments & Deposits solutions? Fill out the form to receive more information from Early Warning®.

By clicking the Submit button below, you agree that the information you have provided is subject to our Privacy Policy.